TRX Price Prediction: Can It Break $0.35 Amid Profit-Taking?

#TRX

- Technical Strength: TRX trades above 20-day MA with MACD turning positive.

- Profit-Taking Pressure: $1.4B sell-off may limit short-term gains but confirms long-term holder confidence.

- Ecosystem Momentum: Tron's news dominance and founder visibility support bullish sentiment.

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

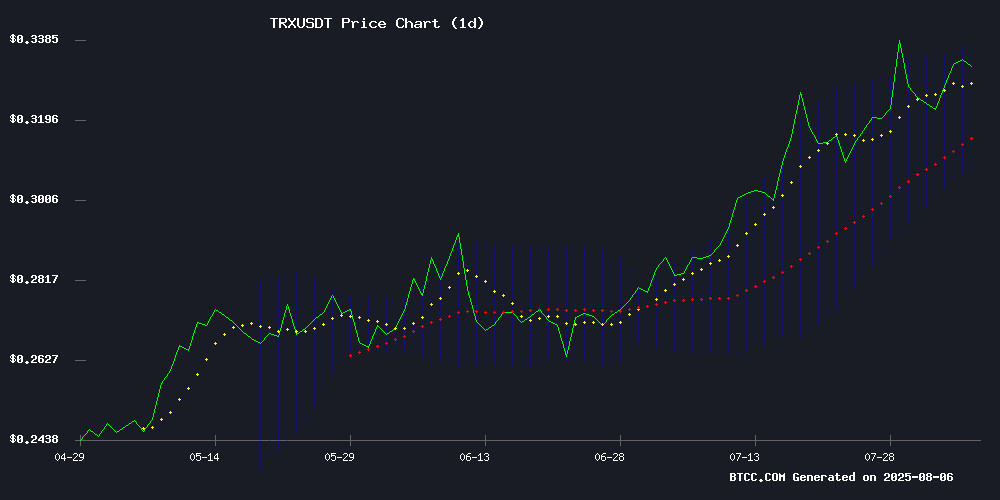

According to BTCC financial analyst James, TRX is currently trading at $0.3375, above its 20-day moving average of $0.3229, indicating a bullish trend. The MACD shows a slight positive crossover (0.000341), suggesting potential upward momentum. Bollinger Bands reveal the price is NEAR the upper band ($0.3389), which may act as resistance. A breakout above this level could target $0.35.

TRX Market Sentiment: Profit-Taking Amid Bullish Signals

BTCC analyst James notes that TRX holders have realized $1.4B in profits, the second-largest sell-off this year. Despite this, TRON's ecosystem remains resilient, with bullish news like Justin Sun's space flight and growing interest in undervalued altcoins. The sell-off may create a buying opportunity if the technical uptrend holds.

Factors Influencing TRX’s Price

TRX Holders Realize $1.4B Profits in Second-Largest Sell-Off This Year

Long-term TRON (TRX) investors cashed out over $1.4 billion in profits within 24 hours, marking the token's second-largest profit-taking event of 2024. Glassnode data reveals this sustained selling wave—averaging nearly $1 billion daily since Saturday—represents the most significant realized profit activity for TRX in months.

The sell-off predominantly originated from wallets holding TRX for 3-5 years, suggesting early adopters from the 2020-2021 cycle are capitalizing on recent gains. Remarkably, this isn't panic selling: key metrics like Spent Output Profit Ratio (SOPR >1) and net unrealized P/L indicate strategic profit-taking during strength. TRX price remains resilient, up 1% amid the sell-off and boasting a 31% YTD gain that outperforms most major altcoins.

Altcoin Deposits to Binance Surge to One-Week High Amid Market Weakness

Altcoin deposits on Binance have reached a one-week high, signaling a potential shift in trader behavior as prices for top assets excluding Bitcoin and stablecoins show weakness. CryptoQuant data reveals cumulative inflows spiked suddenly, sparking speculation over whether this reflects preparation for a sell-off or heightened trading activity.

The surge in deposits coincides with Bitcoin's record rally, suggesting some altcoin holders may be positioning to capitalize on the strong market. Historical patterns indicate such inflows often precede local market tops and subsequent drawdowns.

Notably, the 45,000+ incoming transactions mark a sharp reversal from months of subdued activity. While Binance saw pronounced inflows, deposits to Bybit diminished, with Coinbase and smaller exchanges experiencing more moderate increases.

Tether Dominates Blockchain Fees with 40% Share from USDT Transfers

Tether CEO Paolo Ardoino disclosed that 40% of all fees paid on major blockchains are attributed to USDT transfers. The data, spanning nine networks including Ethereum, Tron, and Solana, highlights the stablecoin's outsized role in on-chain activity.

USDT's fee dominance underscores its utility as a hedge against inflation in emerging markets. "Hundreds of millions use USDt daily to protect savings from currency devaluation," Ardoino noted. The metric serves as a proxy for adoption, with users willing to pay native token fees (like ETH) to MOVE the dollar-pegged asset.

The revelation comes as stablecoins increasingly function as the dollar rails of crypto economies. Tether's market share reflects both network effects and the practical demands of cross-border settlements in volatile economies.

4 Highest Potential Cryptos in 2025: Cold Wallet, VeChain, Algorand, & Tron

Investor optimism in cryptocurrency often stems from transformative potential rather than raw metrics. The market's allure lies in identifying undervalued assets with capacity for exponential growth—projects combining technological rigor with real-world adoption.

Cold Wallet (CWT) emerges as a standout presale opportunity at $0.00942, leveraging its acquisition of Plus Wallet's 2 million-user infrastructure. The platform integrates cashback incentives, DAO governance, and zero-knowledge privacy protocols—positioning itself as a dark horse for the 2024-2025 cycle.

VeChain, Algorand, and tron complete the shortlist, each demonstrating unique value propositions in enterprise blockchain, institutional-grade DeFi, and decentralized content ecosystems respectively. These projects exhibit the rare trifecta of technical merit, growing developer activity, and measurable network effects.

Undervalued Altcoins Under $1 Gain Traction as Crypto Markets Show Bullish Signals

Mutuum Finance (MUTM) and TRON (TRX) are emerging as standout altcoins under $1, drawing investor interest amid early signs of a potential bull run. MUTM's decentralized credit market innovations have fueled a $14.1 million presale, with Phase 6 currently priced at $0.035—offering a projected 71.43% ROI at its $0.06 listing price. Over 14,800 token holders have been onboarded.

TRX consolidates NEAR $0.32 after breaking key resistance, with technical analysis suggesting a cup-and-handle pattern could propel it toward $0.38. The Tron network's liquidity remains robust, underscored by $22 billion in USDT minted this year.

TRX Hits $0.42 Amid Profit-Taking Concerns

Tron's TRX surged to $0.42, fueled by a combination of sustained bullish momentum and a strategic burn mechanism that has removed 40 billion tokens from circulation. Year-to-date realized gains now rank among the highest in crypto, trailing only bitcoin and Ethereum.

The rally shows signs of strain as profit-taking emerges. Glassnode data reveals holders from the 2020-2021 cycle are capitalizing on gains, with the network's SOPR metric hovering at 1.04. Daily volume remains robust at $920 million despite price stagnation.

August's burn rate accelerated dramatically, destroying 166 million TRX—ten times July's figures. This artificial scarcity play appears to be losing steam against mounting sell pressure from long-term holders.

Tron Profit-Taking Reaches $1.4 Billion As Bull Cycle Veterans Cash Out

Long-term Tron holders from the 2020-2021 bull cycle are cashing out $1.4 billion in profits, marking 2024's second-largest single-day profit event for the cryptocurrency. The sustained profit-taking has averaged $1 billion daily since Saturday, representing the most prolonged wave of realized gains on the Tron network in months.

Tron's blockchain activity has surged, processing five times more Tether transactions than ethereum while hosting over $81 billion in USDT tokens. Glassnode data reveals this selloff is driven by three-to-five-year holders, with the Spent Output Profit Ratio confirming investors are locking in gains rather than losses.

Tron (TRX) Investors Cash Out $1.4B in Profits as Long-Term Holders Lead Exodus

Tron's native token TRX has seen its second-largest profit-taking event of 2024, with $1.4 billion in realized gains recorded on August 5. Glassnode data reveals a striking pattern: the majority of sellers are wallets holding TRX for 3-5 years, suggesting early bull market participants are capitalizing on current price stability between $0.32-$0.33.

The scale of profit-taking dwarfs Bitcoin's $665 million and Ethereum's $337 million realized gains during the same period. This sustained exit wave—averaging $1 billion daily since Saturday—marks TRON network's most significant profit realization in months. Market analysts watch closely whether this redistribution will fuel volatility or indicate healthy portfolio rebalancing.

BlockchainFX Emerges as Top Crypto Presale Amid Market Growth

As the cryptocurrency market enters a new phase of expansion, investors are shifting focus from established altcoins to presale opportunities with tangible utility. BlockchainFX ($BFX) has gained prominence with its multi-asset trading platform, offering staking rewards and daily USDT payouts capped at $25,000.

The project distinguishes itself from meme tokens and speculative assets by delivering immediate functionality. Its presale price of $0.018 positions it as a value proposition against higher-market-cap alternatives. Cardano and Tron maintain ecosystem influence, but agile newcomers like BlockchainFX are attracting capital seeking compounding yield mechanisms.

TRON Founder Justin Sun Completes Space Flight as Altcoins Dogecoin and UNIL Gain Attention

TRON founder Justin Sun's $28 million spaceflight captured headlines, but the spotlight is shifting to altcoins with stronger momentum. While TRX struggles below its 30-day high of $0.34, two tokens show breakout potential: Dogecoin and Unilabs Finance's AI-powered UNIL.

UNIL merges DeFi, TradFi, and artificial intelligence as the first AI-backed DeFi asset manager. Its presale token combines utility with governance in a package analysts call "this year's most compelling new protocol." Meanwhile, Dogecoin's price action suggests an imminent surge.

TRON's network metrics tell a bearish story - active addresses dropped 19% monthly to 13 million, while the MACD indicator hints at further declines toward $0.30. The Layer-1 blockchain faces headwinds despite Sun's extraterrestrial publicity stunt.

TRON Defies Profit-Taking Pressure Amid $1.4B Selloff

TRON demonstrates resilience as investors cash out $1.4 billion in profits, yet the altcoin holds steady near the $0.33 resistance level. The network's ability to absorb massive sell orders signals underlying demand.

How High Will TRX Price Go?

James predicts TRX could reach $0.35-$0.42 if it breaks the Bollinger upper band ($0.3389). Key factors include:

| Level | Price (USDT) | Significance |

|---|---|---|

| Resistance | 0.3389 | Bollinger Upper Band |

| Target 1 | 0.3500 | Psychological Level |

| Target 2 | 0.4200 | Previous High (News Reference) |